Interest only loans are an economic debacle that could bust the property market

- Written by Richard Holden, Professor of Economics and PLuS Alliance Fellow, UNSW

Vital Signs is a regular economic wrap from UNSW economics professor and Harvard PhD Richard Holden (@profholden). Vital Signs aims to contextualise weekly economic events and cut through the noise of the data affecting global economies.

This week: This risks of interest only loans that the RBA is ignoring and more revenue for the government ahead of the budget.

Australian taxpayers won’t face a rise in taxes now that Treasurer Scott Morrison announced the government will not increase the Medicare Levy by 0.5% as planned. This was to originally fully fund the National Disability Insurance Scheme (NDIS).

This is on the back of strong company tax receipts stemming from companies using up carry-forward losses accumulated in the wake of the financial crisis.

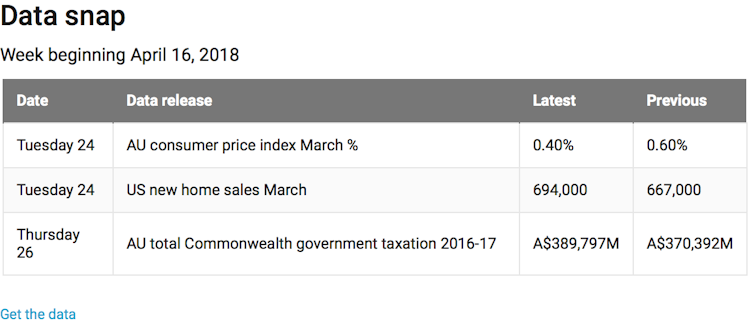

Australian Bureau of Statistics data for 2016/17, released this week, showed tax revenue for the federal government (including taxes received from other levels of government and public corporations) increased A$19.4 billion (5.2%).

The averted tax rise will be welcome news for Australian taxpayers. It also wedges the Labor opposition.

They have said that the NDIS was fully funded on their watch. So now they are proposing a 0.5% tax rise on all incomes over A$87,000. That’s pretty close to full-time male average weekly earnings and comes close to capturing half of Australian households.

The federal budget on May 8 will no doubt have further goodies for voters in the run-up to the net election, which will be either this year or relatively early next year. As usual, we will be reporting directly from the budget lockup.

Read more:

Greenspan’s 'uncertainty principle' and the evolution of Fedspeak

One of the central economic puzzles of the last several years has been persistently low inflation in all advanced economies, despite general economic recovery and falling unemployment.

This week’s Australian consumer price inflation figures revealed a 0.4% increase for the March quarter, and 1.9% for the last 12 months. The March quarter figure was below market expectations of 0.5%, and also the previous (December quarter) figure of 0.6%. Education prices were up 2.6% on the quarter, and health prices up 2.2% (or 4.2% for the year to March 2018).

This puts inflation still below the Reserve Bank of Australia’s (RBA) target band of 2-3%. That band, of course, has been in place since the early 1990s – beginning with this speech by then governor Bernie Fraser.

Numerous central banks around the world have a similar approach. The basic idea is that a central bank can build a reputation over time to commit to monetary policy such that inflation lies in the band.

Now there are pros and cons to this approach to monetary policy, and it has its critics. But that is another tale for another day.

Just assuming that inflation targeting is the correct objective, how is the RBA doing? Well, one small hitch in the plan is that inflation has been outside the band for a long time now (basically since 2014), as the RBA’s own figures show.

Given the level of unemployment in Australia, low wages growth, and stubbornly low inflation, the RBA probably should have cut rates further a fair while back. But they seem, probably rightly, terrified of further fuelling a potential housing bubble.

Meanwhile, the credibility of their commitment to the inflation target withers. If only the regulation of our banking and finance sector had been better for the last, say, decade or two.

Speaking of such regulation, RBA assistant governor Chris Kent gave a speech Tuesday about the important issue of interest-only loans. Kent’s speech was significant because it followed up on remarks in the RBA minutes about the same issue that I discussed in this column last week.

It seems that the RBA “house view” on interest only loans is as follows. There could be a problem but the Australian Prudential Regulation Authority (APRA) stepped in and the banks have voluntarily tightened lending standards recently. Also because the average household with an interest only loan has a buffer of savings, everything will be fine. Nothing to see here.

I hope the RBA’s conclusion is right, but I know for sure that the reasoning is not. It’s actually the marginal household’s financial position and behaviour that matters, not the average household.

The average United States borrower with an adjustable-rate mortgage did not default in 2007, 2008 or 2009. But these mortgages were a huge contributor to the financial crisis, along with subprime mortgages.

Kent dutifully laid out the risks from interest only loans, saying:

Because there’s no need to pay down principal initially, the required payments are lower during the interest-only period. But when that ends, there is a significant step-up in required payments (unless the interest-only loans are rolled over).

Indeed, unless they can be rolled over. Which they can’t now because of APRA and the banks finally doing something.

Now, prices (interest rates) on interest only loans have gone up as part of the bank response. This has led a bunch of folks to shift to amortising loans, where the principal of the loan is paid down over the life of the loan. So those borrowers who haven’t shifted to these loans already, really don’t want to.

Maybe they can’t afford to because of the increased repayments, that can jump 30% or more per month.

So what does happen? First Kent says many borrowers save ahead of time, expecting a rise in repayments. Yes, the prudent ones.

But how many non-prudent borrowers have their been in the Australian property market in recent years? Hint: a lot.

Kent also points to borrowers who seek to refinance their interest only loan. But banks don’t really want to, and APRA doesn’t want to let them. And who is going to be able to? The safer borrowers who did save and so don’t really need to avoid amortisation. The risky borrowers can’t refinance.

Kent says some borrowers will have to cut their spending. Chuckle, chuckle. And the final option is to sell their house.

Sure, no problem, unless lots of folks want to do that all at once. Then it’s a fire sale that detonates the housing market.

I really do hope we escape the interest only debacle unscathed. But if we do it will be pure, dumb luck, not a consequence of good design or sound regulation.

It definitely doesn’t justify the RBA’s house view in Kent’s concluding remarks that:

The substantial transition away from interest-only loans over the past year has been relatively smooth overall, and is likely to remain so. Nevertheless, it is something that we will continue to monitor closely.

Perhaps a there should have been a little more monitoring before interest only loans got to be 40% of all loans and more than half of the loan book of one of our biggest banks.

Australian taxpayers won’t face a rise in taxes now that Treasurer Scott Morrison announced the government will not increase the Medicare Levy by 0.5% as planned. This was to originally fully fund the National Disability Insurance Scheme (NDIS).

This is on the back of strong company tax receipts stemming from companies using up carry-forward losses accumulated in the wake of the financial crisis.

Australian Bureau of Statistics data for 2016/17, released this week, showed tax revenue for the federal government (including taxes received from other levels of government and public corporations) increased A$19.4 billion (5.2%).

The averted tax rise will be welcome news for Australian taxpayers. It also wedges the Labor opposition.

They have said that the NDIS was fully funded on their watch. So now they are proposing a 0.5% tax rise on all incomes over A$87,000. That’s pretty close to full-time male average weekly earnings and comes close to capturing half of Australian households.

The federal budget on May 8 will no doubt have further goodies for voters in the run-up to the net election, which will be either this year or relatively early next year. As usual, we will be reporting directly from the budget lockup.

Read more:

Greenspan’s 'uncertainty principle' and the evolution of Fedspeak

One of the central economic puzzles of the last several years has been persistently low inflation in all advanced economies, despite general economic recovery and falling unemployment.

This week’s Australian consumer price inflation figures revealed a 0.4% increase for the March quarter, and 1.9% for the last 12 months. The March quarter figure was below market expectations of 0.5%, and also the previous (December quarter) figure of 0.6%. Education prices were up 2.6% on the quarter, and health prices up 2.2% (or 4.2% for the year to March 2018).

This puts inflation still below the Reserve Bank of Australia’s (RBA) target band of 2-3%. That band, of course, has been in place since the early 1990s – beginning with this speech by then governor Bernie Fraser.

Numerous central banks around the world have a similar approach. The basic idea is that a central bank can build a reputation over time to commit to monetary policy such that inflation lies in the band.

Now there are pros and cons to this approach to monetary policy, and it has its critics. But that is another tale for another day.

Just assuming that inflation targeting is the correct objective, how is the RBA doing? Well, one small hitch in the plan is that inflation has been outside the band for a long time now (basically since 2014), as the RBA’s own figures show.

Given the level of unemployment in Australia, low wages growth, and stubbornly low inflation, the RBA probably should have cut rates further a fair while back. But they seem, probably rightly, terrified of further fuelling a potential housing bubble.

Meanwhile, the credibility of their commitment to the inflation target withers. If only the regulation of our banking and finance sector had been better for the last, say, decade or two.

Speaking of such regulation, RBA assistant governor Chris Kent gave a speech Tuesday about the important issue of interest-only loans. Kent’s speech was significant because it followed up on remarks in the RBA minutes about the same issue that I discussed in this column last week.

It seems that the RBA “house view” on interest only loans is as follows. There could be a problem but the Australian Prudential Regulation Authority (APRA) stepped in and the banks have voluntarily tightened lending standards recently. Also because the average household with an interest only loan has a buffer of savings, everything will be fine. Nothing to see here.

I hope the RBA’s conclusion is right, but I know for sure that the reasoning is not. It’s actually the marginal household’s financial position and behaviour that matters, not the average household.

The average United States borrower with an adjustable-rate mortgage did not default in 2007, 2008 or 2009. But these mortgages were a huge contributor to the financial crisis, along with subprime mortgages.

Kent dutifully laid out the risks from interest only loans, saying:

Because there’s no need to pay down principal initially, the required payments are lower during the interest-only period. But when that ends, there is a significant step-up in required payments (unless the interest-only loans are rolled over).

Indeed, unless they can be rolled over. Which they can’t now because of APRA and the banks finally doing something.

Now, prices (interest rates) on interest only loans have gone up as part of the bank response. This has led a bunch of folks to shift to amortising loans, where the principal of the loan is paid down over the life of the loan. So those borrowers who haven’t shifted to these loans already, really don’t want to.

Maybe they can’t afford to because of the increased repayments, that can jump 30% or more per month.

So what does happen? First Kent says many borrowers save ahead of time, expecting a rise in repayments. Yes, the prudent ones.

But how many non-prudent borrowers have their been in the Australian property market in recent years? Hint: a lot.

Kent also points to borrowers who seek to refinance their interest only loan. But banks don’t really want to, and APRA doesn’t want to let them. And who is going to be able to? The safer borrowers who did save and so don’t really need to avoid amortisation. The risky borrowers can’t refinance.

Kent says some borrowers will have to cut their spending. Chuckle, chuckle. And the final option is to sell their house.

Sure, no problem, unless lots of folks want to do that all at once. Then it’s a fire sale that detonates the housing market.

I really do hope we escape the interest only debacle unscathed. But if we do it will be pure, dumb luck, not a consequence of good design or sound regulation.

It definitely doesn’t justify the RBA’s house view in Kent’s concluding remarks that:

The substantial transition away from interest-only loans over the past year has been relatively smooth overall, and is likely to remain so. Nevertheless, it is something that we will continue to monitor closely.

Perhaps a there should have been a little more monitoring before interest only loans got to be 40% of all loans and more than half of the loan book of one of our biggest banks.

Authors: Richard Holden, Professor of Economics and PLuS Alliance Fellow, UNSW