It's great to want wage growth, but the way we're going about it could stunt the recovery

- Written by Michael Keating, Visiting Fellow, College of Business & Economics, Australian National University

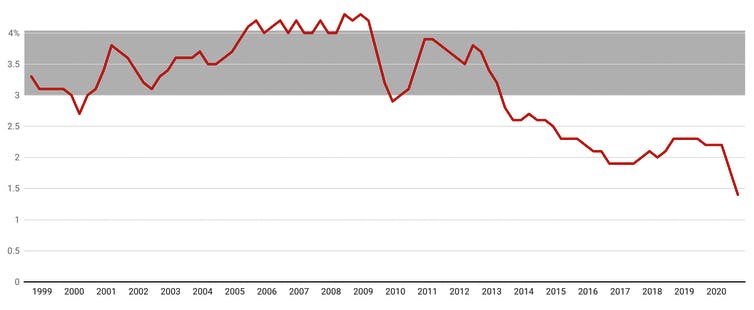

The Reserve Bank is going all out for wage growth “sustainably above 3%” — the kind of wage growth Australia hasn’t seen for the best part of a decade.

It has already committed itself to achieving an “actual” inflation target, sustainably between 2% and 3%, saying it won’t lift its cash rate until that happens.

That’s a substantial hardening of its earlier target, which was to merely see “progress towards” an inflation rate of 2% to 3%.

In board minutes released this week it says that to get inflation to 2-3% it is likely wage growth will have to be “sustainably above 3%” — well above where it has been for the past seven years.

The bank received encouragement on Thursday with news of an extra 88,700 Australians in work and a dive in unemployment rate from 6.3% to 5.8%, but its minutes say that for wages to climb to where it wants them, tightness in the labour market would need to be “sustained”.

Actual wage growth, low for years

Wage price index, total hourly rates of pay excluding bonuses, private and public, annual.

ABS

Wage price index, total hourly rates of pay excluding bonuses, private and public, annual.

ABS

It means monetary policy (interest rates) is tied to a recovery in wage growth, something about whose timing we’ve little idea.

Things aren’t as simple as the bank suggests

For decades now macroeconomic policy in Australia (and elsewhere) has been built around the idea of a stable relationship between the level of unemployment and the rate of inflation of both wages and prices – the so-called Phillips curve, named after the economist (and engineer) who first measured it.

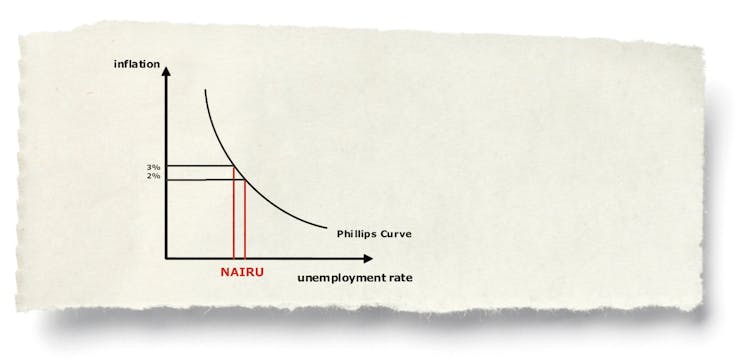

The target rate of unemployment, the “non-accelerating inflation rate of unemployment” (NAIRU) is then defined as the rate of unemployment consistent with achieving an inflation target, in the case of Australia’s Reserve Bank, low and stable rate inflation of 2-3%.

The target rate of unemployment, the “non-accelerating inflation rate of unemployment” (NAIRU) is then defined as the rate of unemployment consistent with achieving an inflation target, in the case of Australia’s Reserve Bank, low and stable rate inflation of 2-3%.

But (and this what the simple graphs don’t acknowledge and the Reserve Bank has been slow to acknowledge) the relationship changes over time.

Between 2011 and 2019 the bank persistently overestimated annual wage growth by about 1 percentage point as actual wage growth steadily declined from about 4% to around 2%, and now to 1.4%.

Nevertheless, despite its poor forecasting record, bank staff continued to suggest that NAIRU had changed little and was close to 5%.

Read more:

Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment

Then in mid 2019, the bank announced that it had been gradually revising down its estimate of NAIRU to 4½%.

There was a “two-thirds chance that the current NAIRU is between 4% and 5%, and a 95% it is between 3½% and 5½%”.

And most recently in a speech last week Governor Philip Lowe said it was “certainly possible that Australia can achieve and sustain an unemployment rate in the low 4s, although only time will tell”.

The relationship might barely exist

To my mind, these changes are based on the definitional assumption that lower wage increases reflect a lowering of NAIRU.

But there are reasons to believe that much of the stagnation in wages growth is due to things other than the degree of slack in the labour market.

Lowe himself acknowledged in his speech “powerful structural factors at work”.

He cited

increased competition in goods markets, which makes firms very conscious of cost increases

the trend towards more services being provided internationally

advances in technology, which have reduced the demand for some types of skills and increased the demand for others

changes to the global supply of labour and regulation of labour markets

I agree, particularly with the last two points. But what the bank doesn’t seem to have accounted for is the way in which these structural factors have changed the distribution of income and the likely distribution of wage rises.

Low wage rises for low earners hurt us

Macroeconomic measures of the kind being talked about — interest rate and spending and tax adjustments — are indeed likely to accelerate wage growth, but much more for so for the (already higher earning) workers who have skills in demand.

And because high earners generally save more of what they earn than low earners, macroeconomic measures of the kind being talked about are likely to push up aggregate wage growth without boosting economic activity as much as is possible and without fully employing the population.

Read more:

From here on the recovery will need redistribution

Eventually, in response to what will be inadequate demand, the private sector investment is likely to sink. This will result in less innovation and therefore lower productivity growth, lowering what the economy is capable of.

It’s the sort of situation Australia (and other advanced economies) were in before the COVID recession. In the United States it was called “secular stagnation”.

We need to actively push up low wages

To avoid it we will have to rely on more than standard measures to boost wages.

The best place to start would be to boost spending on education and training to improve the skills and earning power of people in middle and lower-level jobs, and better suit skills to needs.

This would boost both demand and the productive capacity of the economy, and without adding to inflation.

It would also help if the government stopped its resistance to wage increases, starting with the removal of public service wage freezes.

But (and this what the simple graphs don’t acknowledge and the Reserve Bank has been slow to acknowledge) the relationship changes over time.

Between 2011 and 2019 the bank persistently overestimated annual wage growth by about 1 percentage point as actual wage growth steadily declined from about 4% to around 2%, and now to 1.4%.

Nevertheless, despite its poor forecasting record, bank staff continued to suggest that NAIRU had changed little and was close to 5%.

Read more:

Josh Frydenberg has the opportunity to transform Australia, permanently lowering unemployment

Then in mid 2019, the bank announced that it had been gradually revising down its estimate of NAIRU to 4½%.

There was a “two-thirds chance that the current NAIRU is between 4% and 5%, and a 95% it is between 3½% and 5½%”.

And most recently in a speech last week Governor Philip Lowe said it was “certainly possible that Australia can achieve and sustain an unemployment rate in the low 4s, although only time will tell”.

The relationship might barely exist

To my mind, these changes are based on the definitional assumption that lower wage increases reflect a lowering of NAIRU.

But there are reasons to believe that much of the stagnation in wages growth is due to things other than the degree of slack in the labour market.

Lowe himself acknowledged in his speech “powerful structural factors at work”.

He cited

increased competition in goods markets, which makes firms very conscious of cost increases

the trend towards more services being provided internationally

advances in technology, which have reduced the demand for some types of skills and increased the demand for others

changes to the global supply of labour and regulation of labour markets

I agree, particularly with the last two points. But what the bank doesn’t seem to have accounted for is the way in which these structural factors have changed the distribution of income and the likely distribution of wage rises.

Low wage rises for low earners hurt us

Macroeconomic measures of the kind being talked about — interest rate and spending and tax adjustments — are indeed likely to accelerate wage growth, but much more for so for the (already higher earning) workers who have skills in demand.

And because high earners generally save more of what they earn than low earners, macroeconomic measures of the kind being talked about are likely to push up aggregate wage growth without boosting economic activity as much as is possible and without fully employing the population.

Read more:

From here on the recovery will need redistribution

Eventually, in response to what will be inadequate demand, the private sector investment is likely to sink. This will result in less innovation and therefore lower productivity growth, lowering what the economy is capable of.

It’s the sort of situation Australia (and other advanced economies) were in before the COVID recession. In the United States it was called “secular stagnation”.

We need to actively push up low wages

To avoid it we will have to rely on more than standard measures to boost wages.

The best place to start would be to boost spending on education and training to improve the skills and earning power of people in middle and lower-level jobs, and better suit skills to needs.

This would boost both demand and the productive capacity of the economy, and without adding to inflation.

It would also help if the government stopped its resistance to wage increases, starting with the removal of public service wage freezes.

Authors: Michael Keating, Visiting Fellow, College of Business & Economics, Australian National University