How Westpac is alleged to have broken anti-money laundering laws 23 million times

- Written by Ian Fargher, Lecturer in Accounting, University of Wollongong

Australia’s second-biggest bank, Westpac, is poised to overtake the biggest, the Commonwealth Bank. Not in terms of assets, earnings or market capitalisation, but in having to pay the heftiest fine in Australian corporate history.

Westpac is accused of breaching laws aimed at hindering criminal money laundering and the financing of terrorism. With some of those breaches involving supicious transactions in South-East Asia, it is alleged Westpac has potentially facilitated the most heinous of crimes – the commerce of child sex abuse.

Each breach carries a penalty of up to A$63,000. Westpac is accused of 23 million breaches.

Read more: Westpac's scandal highlights a system failing to deter corporate wrongdoing

That means it could potentially be fined more than A$1 trillion. The actual fine is likely to be bargained down, as Commonwealth Bank did in agreeing to pay A$700 million in 2018 for its own breaches of anti-money-laundering provisions.

Even so, Westpac is still likely to be up for more than A$1 billion.

So what exactly is it accused of doing wrong, and what should it have done? Here’s a quick guide to how Australia’s anti-money-laundering laws work.

Know your customer

Know your customer.

AUSTRAC poster

Know your customer.

AUSTRAC poster

The Australian Transaction Reports and Analysis Centre (AUSTRAC) requires organisations that handle big amounts of money, such as banks and casinos, to monitor transactions and report suspicious ones.

AUSTRAC assembles intelligence and passes it onto partner agencies such as the Australian Federal Police.

The requirements spring from Australian legislation and obligations under international agreements.

One of the better-known requirements is an obligation to report any cash transaction exceeding A$10,000.

Less well-known, but perhaps more onerous, is the obligation to “know your customer”.

“Know your customer” means banks and other financial services organisations must collect information about their customers and assess their legitimate business behaviours before entering into an agreement, such as the provision of international money transfer services.

Read more: VIDEO: Michelle Grattan on the Westpac scandal - and changes to robo-debt

Banks must then monitor ongoing customer transactions. If, for example, a business makes a large number of small cash transactions remitted to one overseas address then the bank needs to understand the purpose of the transactions and the legitimacy of the receiver.

What it’s alleged Westpac did

Federal Court notice of filing

AUSTRAC expects each organisation to identify patterns of risky transactions, such as third parties undertaking transfers to and from accounts for no apparent reason, or regular international funds transfers to high-risk jurisdictions.

AUSTRAC claims Westpac failed to appropriately assess transactions to the Philippines and South East Asia that have known financial indicators relating to potential child exploitation risks.

Westpac is also accused of failing to understand and monitor transactions of money from its accounts to small intermediary banks located in countries where terrorist organisation are known to operate.

This does not necessarily mean money was transferred to terrorists. It does mean there was a risk, and AUSTRAC should have been informed.

‘Fallen short’

The senior management of banks and other cash-handling organisations is expected to fully support anti-money-laundering and counter-terrorism-financing efforts. Among other things, a compliance officer is expected report to the board and be given the authority and resources to ensure the organisation is meeting its obligations.

On Wednesday AUSTRAC accused Westpac’s senior management of indifference and failure to adequately invest in the technology and programs needed to monitor and report patterns of potentially suspicious transactions.

Federal Court notice of filing

AUSTRAC expects each organisation to identify patterns of risky transactions, such as third parties undertaking transfers to and from accounts for no apparent reason, or regular international funds transfers to high-risk jurisdictions.

AUSTRAC claims Westpac failed to appropriately assess transactions to the Philippines and South East Asia that have known financial indicators relating to potential child exploitation risks.

Westpac is also accused of failing to understand and monitor transactions of money from its accounts to small intermediary banks located in countries where terrorist organisation are known to operate.

This does not necessarily mean money was transferred to terrorists. It does mean there was a risk, and AUSTRAC should have been informed.

‘Fallen short’

The senior management of banks and other cash-handling organisations is expected to fully support anti-money-laundering and counter-terrorism-financing efforts. Among other things, a compliance officer is expected report to the board and be given the authority and resources to ensure the organisation is meeting its obligations.

On Wednesday AUSTRAC accused Westpac’s senior management of indifference and failure to adequately invest in the technology and programs needed to monitor and report patterns of potentially suspicious transactions.

Westpac's weekend response.

On Sunday Westpac’s chairman Lindsay Maxsted said based on its current understanding, the board did not believe that there has been any indifference by any member of the executive team, including its chief executive.

But he said Westpac had “fallen short”.

He understood “the gravity of the issues” and had “deep sorrow for failings by Westpac”.

The bank would withhold all or part of bonuses from its executive team subject to the outcome of an external investigation, which would be made public.

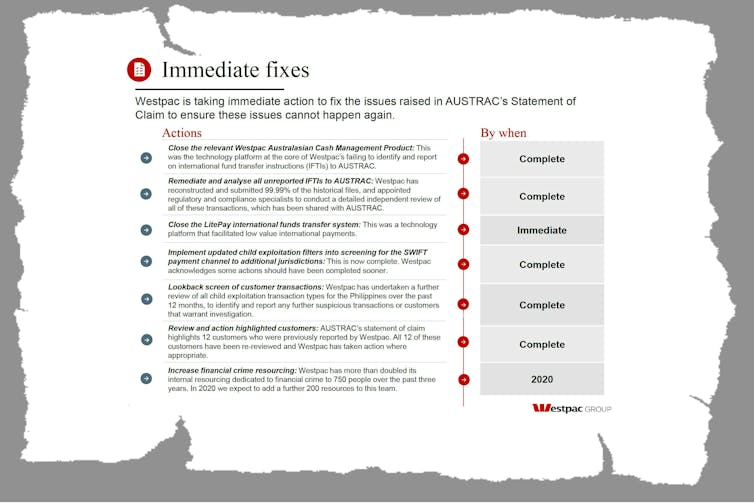

In the meantime Westpac announced a response plan that includes closing one of the products used to facilitate transactions, lifting screening standards, and “protecting people” by, among other things, spending A$18 million over three years to tackle online sexual exploitation of children in the Philippines.

Westpac's weekend response.

On Sunday Westpac’s chairman Lindsay Maxsted said based on its current understanding, the board did not believe that there has been any indifference by any member of the executive team, including its chief executive.

But he said Westpac had “fallen short”.

He understood “the gravity of the issues” and had “deep sorrow for failings by Westpac”.

The bank would withhold all or part of bonuses from its executive team subject to the outcome of an external investigation, which would be made public.

In the meantime Westpac announced a response plan that includes closing one of the products used to facilitate transactions, lifting screening standards, and “protecting people” by, among other things, spending A$18 million over three years to tackle online sexual exploitation of children in the Philippines.

Extract from Westpac's weekend response.

Not alone

Two years ago it was Commonwealth Bank that fell foul of AUSTRAC for allowing money to go out of the country without checks.

Earlier this month the National Australia Bank confirmed that it too was also in discussions with AUSTRAC.

The banking royal commission exposed ways in which elements within financial institutions seemed to regard strict compliance with the law as optional. AUSTRAC has has made it clear it is not, when it comes to money laundering.

Extract from Westpac's weekend response.

Not alone

Two years ago it was Commonwealth Bank that fell foul of AUSTRAC for allowing money to go out of the country without checks.

Earlier this month the National Australia Bank confirmed that it too was also in discussions with AUSTRAC.

The banking royal commission exposed ways in which elements within financial institutions seemed to regard strict compliance with the law as optional. AUSTRAC has has made it clear it is not, when it comes to money laundering.

Authors: Ian Fargher, Lecturer in Accounting, University of Wollongong