Year of Extremes: 2024 Market Review by Global Broker Octa

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 18 December 2024 - 2024 has been a year of contradictory events, significant economic changes, and major political shifts. On a positive note, it was the year when global central banks finally managed to tackle inflation, partly induced by the negative and far-reaching effects of the COVID pandemic and partly by the more recent geopolitical events.

After holding borrowing costs near record highs for most of 2023, almost all major central banks started to cut rates in 2024. However, the pace of interest rate reductions varied, leading to a divergence in monetary policy expectations between different economies, which, in turn, resulted in notable exchange rate fluctuations among major currencies.

On a negative note, however, 2024 has been a year of lingering political uncertainty and geopolitical instability. Although investors learned to coexist with the simmering conflicts in Eastern Europe and the Middle East, a sense of underlying unease persisted. Adding to this sense of anxiety is the changing political landscape.

Indeed, numerous elections took place in tens of countries around the world in 2024. Investors were particularly concerned about the parliamentary elections in France, the general elections in the United Kingdom, and the presidential and congressional elections in the United States. The market still feels the effect of these elections, with traders and investors anticipating major changes in economic policies and trying to front-run their impact on global assets.

The U.S. Dollar (USD) has been the best-performing currency in 2024 among the 20 global currencies that Octa Broker tracks. From 29 December 2023 to 13 December 2024, the U.S. dollar index (DXY), which measures the value of the greenback against the basket of six foreign currencies (the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc) rose by almost 6%. However, the index has undergone substantial fluctuations over the course of the year. Kar Yong Ang, a financial market analyst at Octa Broker, explains: 'The dollar index has been on a rollercoaster ride in 2024, soaring to new multi-month heights and plummeting to fresh multi-month lows. Although the greenback looks like the best-performing currency in 2024 so far, the lion's share of its appreciation occurred during the latter part of the year and has been mostly driven by expectations for a major shift in U.S. trade policy.'

Indeed, the market is concerned that Donald Trump's proposed immigration and trade policies could have inflationary consequences, prompting the Federal Reserve (Fed) to adopt a less dovish monetary policy. As a result, the divergence in investors' monetary policy expectations between the Fed and other major central banks has widened, leading to higher capital inflows into the U.S. dollar. Furthermore, the U.S. economy has been outperforming other advanced economies in 2024 and is expected to continue to do better than the rest in 2025 as well. According to the International Monetary Fund (IMF), real gross domestic product (GDP) growth of advanced economies in 2024 will average just 1.8%, whereas the U.S. GDP is projected to expand by 2.8%.

Because the dollar advanced higher, most major currencies are poised to conclude the year with negative performance. The only exception is the British pound, which is anticipated to finish the year virtually unchanged compared to 2023. 'The relative strength of the U.S. dollar is only one of many reasons why most other major currencies underperformed in 2024. Other factors, however, are specific to individual countries and a major bearish factor this year specifically has been the lack of political certainty, which currencies do not like,' says Kar Yong Ang, a financial market analyst at Octa Broker. Indeed, EURUSD, the most liquid and widely traded foreign exchange (Forex) pair in the world, has been weakened by political uncertainty in the eurozone's largest economies—France and Germany—where political stalemate led to high-profile resignations and early elections. Likewise, when the U.K. Prime Minister Rishi Sunak called a snap parliamentary election, GBPUSD experienced one of the biggest one-day declines of 2024. Moreover, the sluggish growth in the eurozone and the U.K. has prompted investors to anticipate additional rate cuts from both the European Central Bank (ECB) and the Bank of England (BoE). In contrast, the Fed is expected to slow down its easing cycle, further widening the interest rate differential between the U.S. dollar on the one hand and the euro and sterling on the other.

Despite its safe-haven status, the Japanese yen (JPY) was the most volatile currency among the majors. Three-month implied options volatility for the yen, a measure of trader hedging demand, averaged around 9.73% in 2024, whereas the total average across seven major currencies was 7.46%. 'USDJPY traders have had a wild ride in 2024. It has been a total rollercoaster, to be honest. I think fortunes were made and lost here very quickly. This outgoing year has been truly historical for the JPY,' says Kar Yong Ang, a financial market analyst at Octa Broker. Indeed, during the year's first half, the bullish dollar momentum has propelled the pair to a multi-decade high. Then, as rumours of potential intervention by Japanese authorities to bolster the yen began to spread, the USDJPY pair started to decline. A massive sell-off accelerated in late July after the Bank of Japan (BoJ) raised interest rates to 15-year highs and announced details on how it will reduce its huge bond buying. Kar Yong Ang explains: 'At that time, it looked like BoJ was taking a surprisingly hawkish stance. Its decision really shook the markets and caused investors to reassess popular JPY carry-trades.'

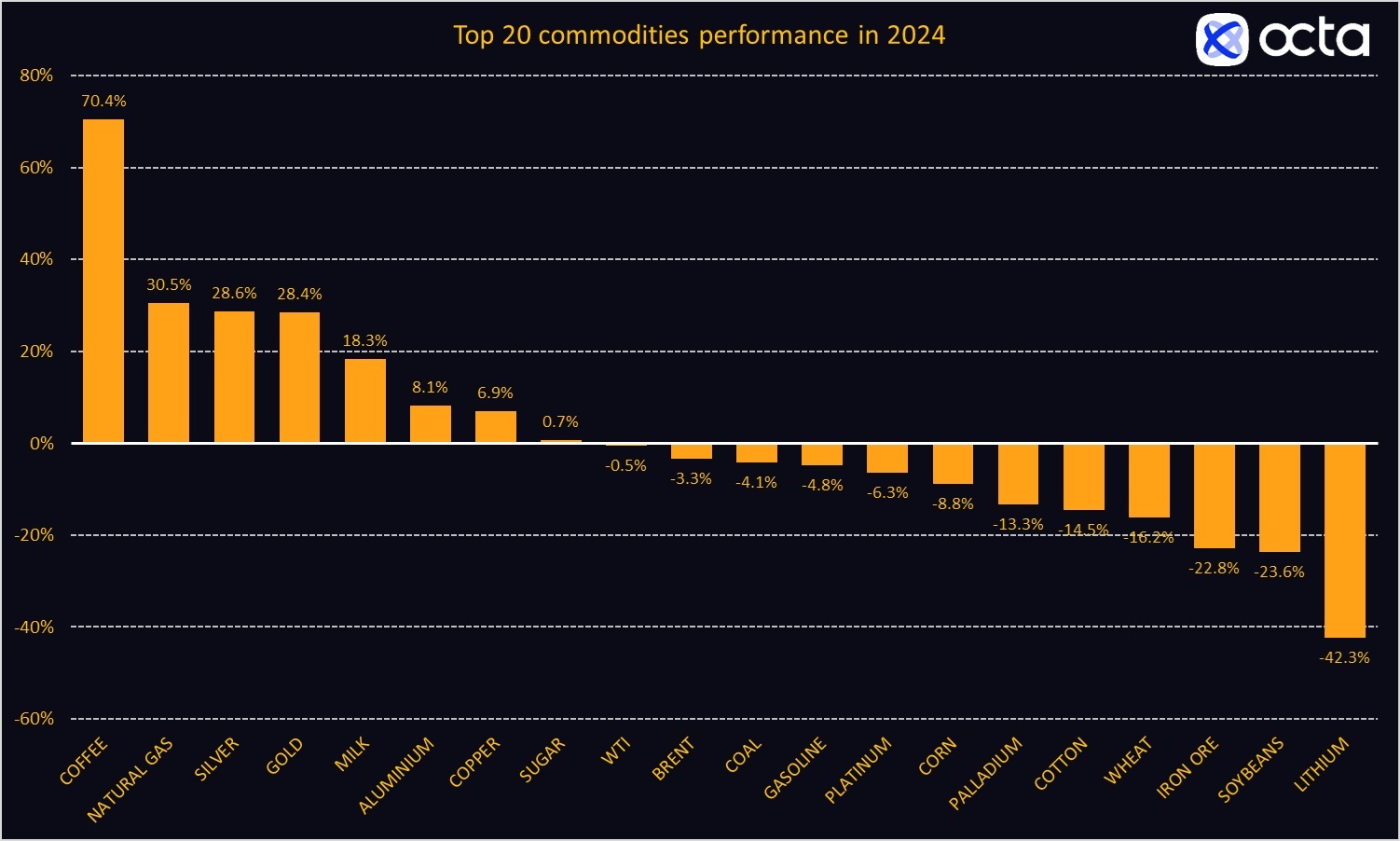

The commodities' performance varied greatly, and each deserves a separate story to tell, but coffee, lithium, gold, and silver have certainly been the biggest stories in 2024.

Just recently, the prompt-month futures contract of arabica coffee traded on Intercontinental Exchange (ICE) hit an all-time high. It is up some 70% year-over-year (y-o-y), which makes it the best-performing commodity in 2024 among 20 other commodities that Octa Broker tracks. 'Like many other soft commodities, both arabica and robusta coffee futures are almost entirely driven by the whims of the weather. This year, Brazil, [the world's largest coffee producer], experienced its worst drought in 70 years, whereas Vietnam, [another key producer] was faced with both drought and heavy rainfall,' says Kar Yong Ang, a financial market analyst at Octa Broker. Indeed, according to official customs data, Vietnam's coffee exports in the first half of this year were 893,820 metric tons, down 11.4% from a year earlier. Traders are very much concerned about the 2025 global crop outlook, and prices have reflected these worries.

In contrast, lithium has been the worst-performing commodity in 2024 as the sale of electric vehicles (EV) started to level off while capital investments from previous years boosted production capacity and led to oversupply. According to Refinitiv, the price of Lithium Hydroxide futures contracts traded on the Commodity Exchange (COMEX) was down 42.3% y-o-y as of December 13, 2024.

As for precious metals, 2024 has been a record-setting year, especially for gold. The price for the yellow metal has been setting a new all-time high essentially every month in 2024. Kar Yong Ang, a financial market analyst at Octa Broker, outlines three main factors that have contributed to such a meteoric rise in gold prices. 'It all boils down to three sources of demand: safe-haven demand due to intensifying geopolitical tensions, investor demand due to less tight monetary policy globally, and structural demand from global central banks as part of de-dollarization and diversification efforts.' As many times before, gold has once again proved its underlying value as a protective asset during times of uncertainty and may continue to shine in the months ahead. Although the price of silver did not set any new records, its y-o-y performance was even more impressive than that of gold: +28.6% (as of December 13).

'Perhaps surprisingly, but despite growing geopolitical tensions, crude oil prices went down annually. This is mostly because non-OPEC members—notably, the U.S.—have managed to increase production but also because investors were worrying about the health of the Chinese economy, the main importer of crude oil,' says Kar Yong Ang, a financial market analyst at Octa Broker.

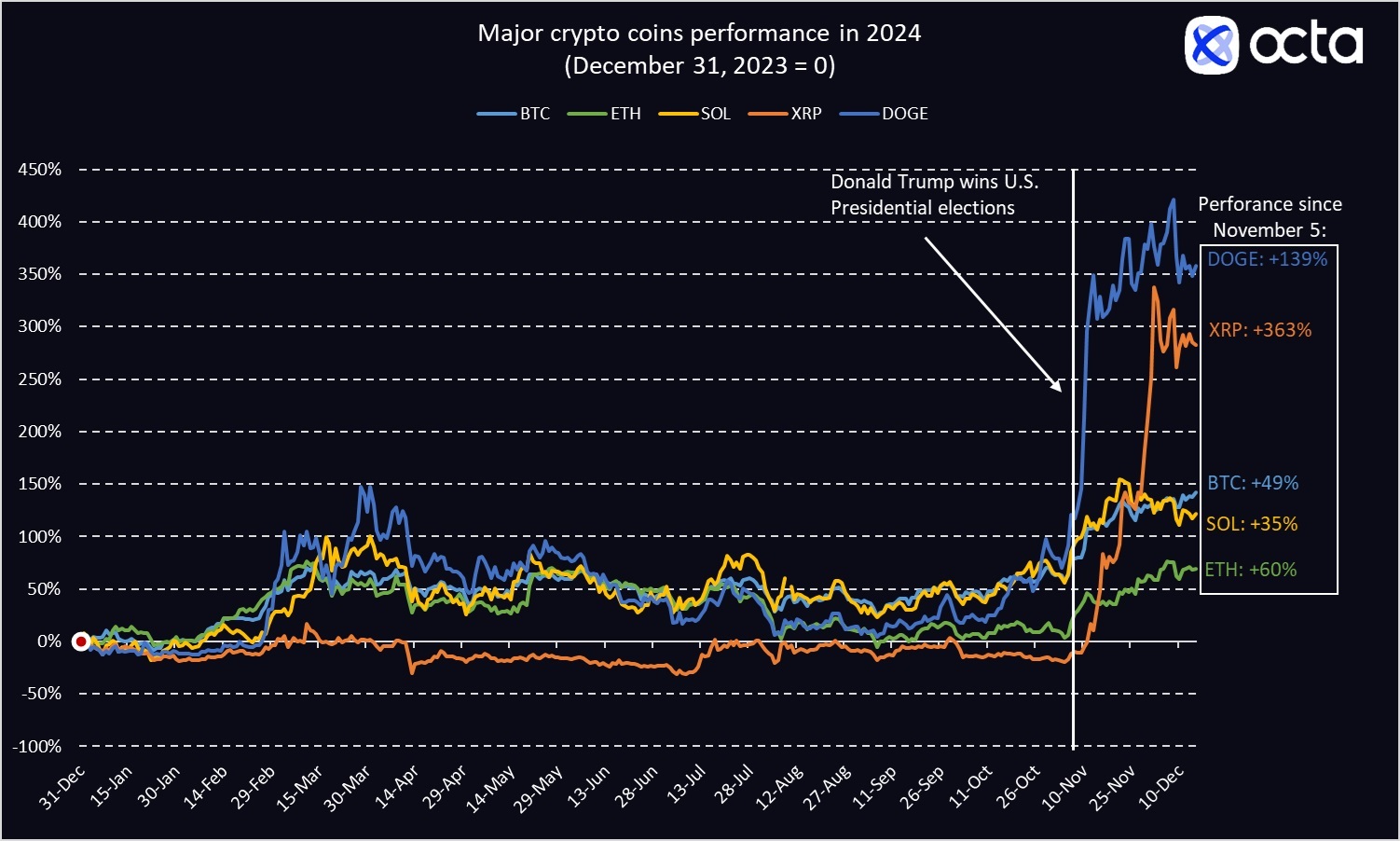

2024 also witnessed significant developments in the cryptocurrency market, particularly for Bitcoin. On March 8, its price set a new all-time high of $70,000. On 5 December, it finally managed to achieve another key milestone of $100,000 per coin. However, Bitcoin was not the best-performing digital coin of 2024. The price of Doge has increased four-fold. Most of the gains in the crypto sphere were in response to Donald Trump's victory in the U.S. presidential elections. Such a favourable market reaction to Trump's victory stems from investors' belief that his Administration, coupled with a friendly Congress, will effectively deregulate the crypto industry, facilitate its expansion, and implement a coherent regulatory framework that will serve investors and consumers for years to come. 'It should be said, argues Kar Yong Ang, that this belief is not without foundation. Trump has managed to lure many crypto fans to his side with his bold moves, clear views, and a strong focus on deregulation.'

The U.S. dollar emerged as the strongest currency, driven by a strong U.S. economy, a tightening monetary policy stance, and expectations of potential policy shifts. Other major currencies, such as the euro and the British pound, faced headwinds from economic sluggishness and political instability.

In the commodity markets, 2024 was a year of extremes. While arabica coffee prices soared to record highs due to supply shortages, lithium prices plummeted as oversupply concerns mounted. Precious metals, particularly gold, experienced a remarkable surge, driven by safe-haven demand, easing monetary conditions, and central bank buying.

Meanwhile, the main crypto coins broke new records and seem to be poised for major transformations in 2025.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.