Industrial automation relies on a range of advanced technologies to ensure precision, speed, and reliability in day-to-day operations. Among these t...

A hydraulic system plays a vital role in powering machinery, controlling movement, and delivering high-force performance across countless industrial...

Running a business these days is a whole lot different to how it was even a few short years ago. Customers are better informed, there's more competi...

As demand for housing, roads and facilities increases, so does the demand for trade workers. According to Infrastructure Australia, the construction i...

Healthcare environments must operate with precision, efficiency, and a strong focus on patient comfort. A well-planned medical fitout Melbourne hel...

Exploring Australia’s coastline, bush tracks or outback locations is far more enjoyable when travelling in a caravan designed for both comfort and...

Australia’s road logistics need major reform to counteract the supply chain issues that are hitting rural and regional communities hard. With 80% of...

Fishing enthusiasts understand that having the right equipment on board makes every trip smoother and more enjoyable. One essential accessory for an...

Across industries like construction, electrical work, plumbing, carpentry, and welding, workers face hazards every single day. For tradesmen, having...

Source: Unsplash

Starting and scaling a retail business is unlikely possible without an effective Point of Sale (POS) system. It is the tech heartbe...

liManaging your own superannuation gives you greater control over investments, retirement planning, and long-term financial decision-making. As inte...

A double carport provides practical, cost-effective protection for two vehicles whilst adding value and functionality to your property. Whether you're...

Outdoor comfort and protection are essential for homes and commercial properties, especially in regions with strong sunlight, high UV exposure, and ...

Jobsite productivity doesn’t depend solely on tools, training, or scheduling. It also hinges on something often overlooked: worker comfort. When e...

Occupational therapy plays a crucial role in helping NDIS participants achieve their goals and improve their daily living skills. For people with disa...

Futures trading has become increasingly popular among Australian traders seeking opportunities across global commodities, indices, currencies and ener...

Home construction and renovation projects require reliable access systems that prioritise both worker safety and structural stability. Whether the p...

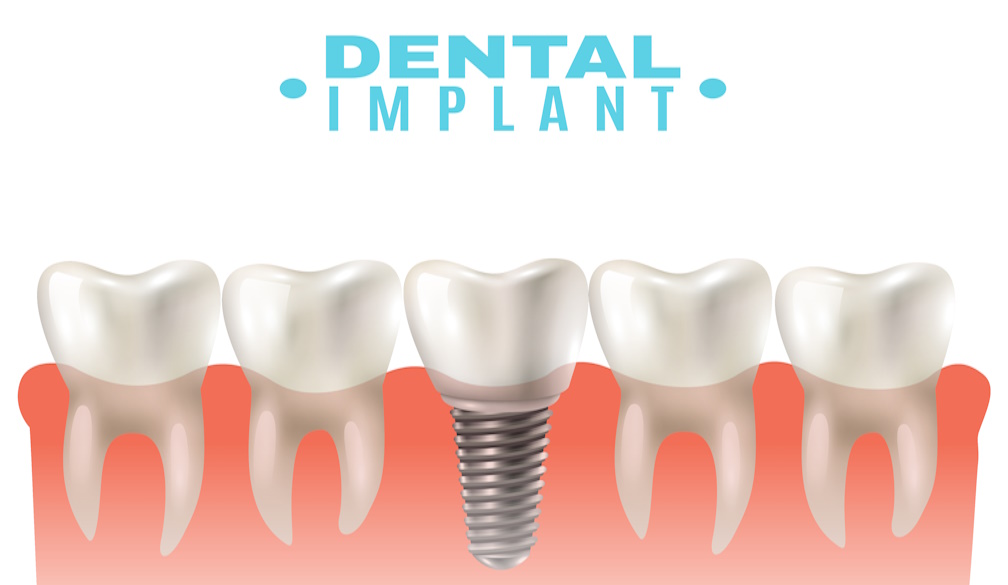

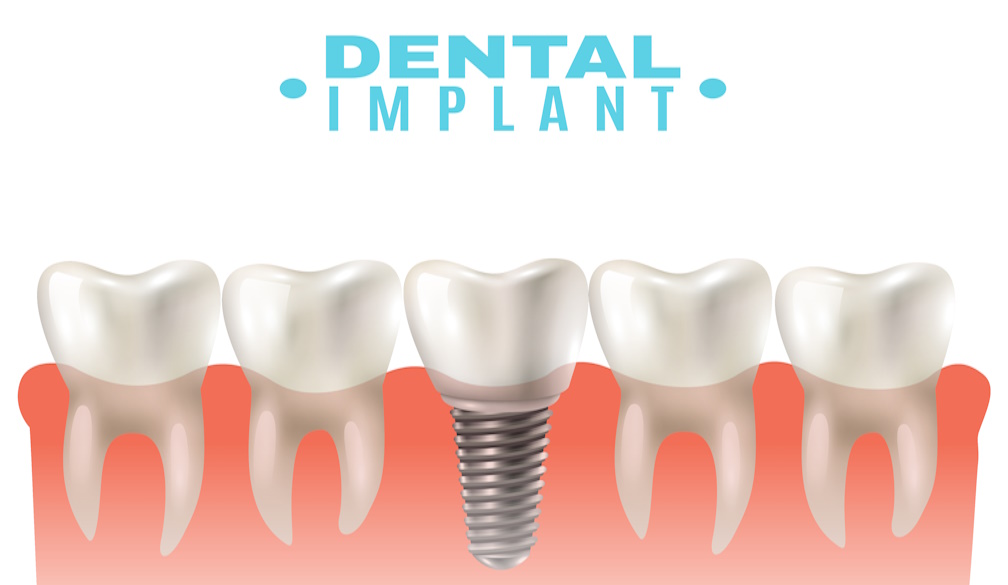

Tooth loss can affect daily life in many ways, including chewing difficulties, speech problems, facial changes, and reduced confidence. Modern denti...