We need a better plan

- Written by Antonia Settle, Academic (McKenzie Postdoctoral Research Fellow), The University of Melbourne

The floods affecting Australia’s eastern seaboard are a “1 in 1,000-year event”, according to New South Wales Premier Dominic Perrottet. But that’s not what science, or the insurance industry, suggests.

Throughout Australia in areas prone to fires, cyclones and floods, home owners and businesses are facing escalating insurance costs as the frequency and severity of extreme weather events increase with the warming climate.

Premiums have risen sharply over the past decade as insurers count the cost of insurance claims and factor in future risks. The latest report from the Intergovernmental Panel on Climate Change, published this week, predicts global warming of 1.5℃ will lead to a fourfold increase in natural disasters.

Rising insurance premiums are creating a crisis of underinsurance in Australia.

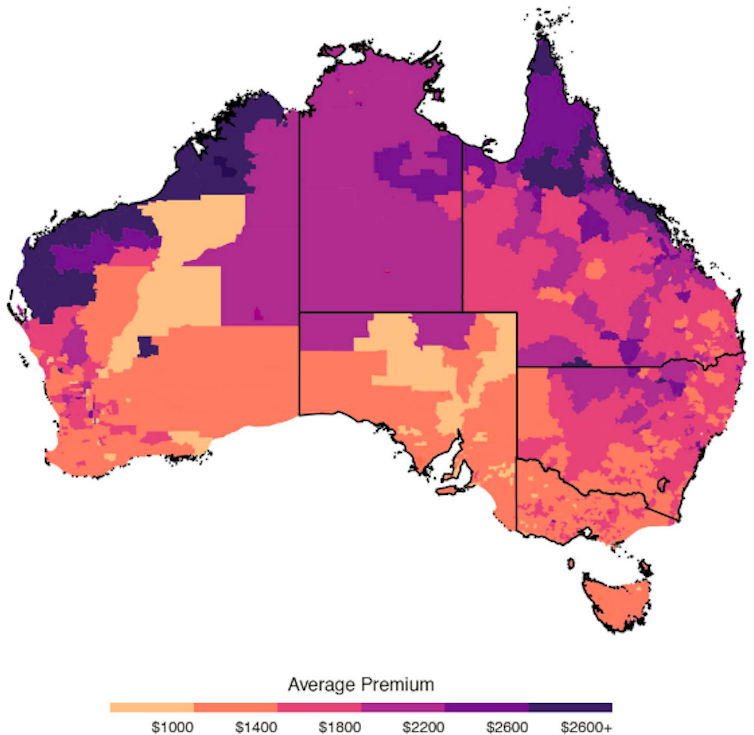

In 2017 the federal government tasked the Australian Competition and Consumer Commission to investigate insurance affordability in northern Australia, where destructive storms and floods are most common. The commission delivered its final report in 2020. It found the average cost of home and contents insurance in northern Australia was almost double the rest of Australia – $2,500 compared with $1,400. The rate of non-insurance was almost double – 20% compared with 11%.

Average premiums for combined home and contents insurance, 2018–19