The edges of home ownership are becoming porous. It's no longer a one-way street

- Written by Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University

This year’s Australian Conference of Economists takes place in Melbourne on July 14-16.

During the conference The Conversation will publish a selection of pieces written by the authors of papers to be delivered at the conference.

More than in many countries, in Australia home ownership has traditionally been seen as a journey, with most of us aspiring to own a home and pay down a mortgage by the time we retire.

Because it’s been seen as a one-way street, we have tended to worry most about the first big transition: moving from renting to getting a mortgage, assuming that afterwards things will be okay. But things are becoming more complicated.

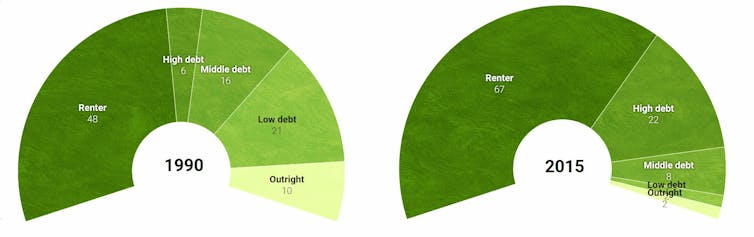

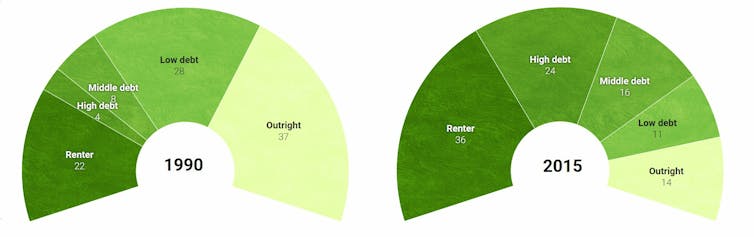

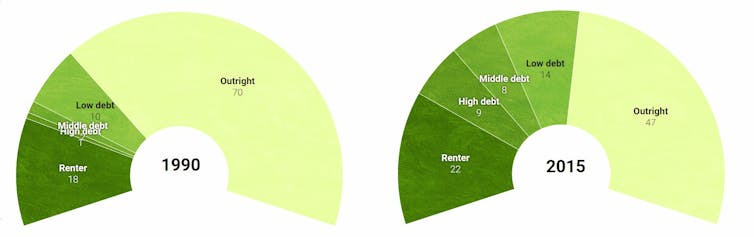

The charts below are built from microdata from the Bureau of Statistics survey of income and housing. Each shows the changing housing profiles of Australians in a particular age group between 1990 and 2015.

The bars show – from left to right – the share of Australians who are renting, have large mortgage debt, moderate mortgage debt, low mortgage debt; and have become outright owners, both in 1990 and 2015.

Then and now. Home tenure by type, per cent

25 - 34 year olds:

35 - 54 year olds:

35 - 54 year olds:

55 - 64 year olds:

55 - 64 year olds:

High debt = mortgage debt-to-income ratio above 200%, middle debt = 100-200%, low debt = below 100%.

Author's calculations, ABS 6553.0 microdata

Less ownership, more churning

In each age group there is more renting and less ownership than there used to be.

And among owners, there is much less outright ownership and much more high debt than there used to be, exposing more of them to the risk of losing their homes.

Indeed, data from the Household, Income and Labour Dynamics survey shows that in the first decade of this century alone, nearly 2 million people left home ownership and returned to renting.

These “leavers” represent one fifth of all home owners in the decade.

But this wasn’t a one-way street either. Of those who lost their home, nearly two-thirds regained home ownership later in the decade. Astonishingly, 7% of these “churners” moved in and out of home ownership more than once.

Who’s leaving, who’s churning?

The edges of home ownership are becoming permeable, in an especially Australian way. Leavers and churners are more common in Australia than in Britain, a country which on the surface has a similar high home ownership rate and a well-developed mortgage market.

Leavers appear to be characterised by mortgage stress, divorce or relationship breakdown and poor health. They have better chances to regaining ownership if they were able to extract relatively large amounts of home equity before they leave.

Those who are able to find rent-free housing, say from parents, find it easier to save for a deposit to get them back into home ownership.

Some are able to directly access the “bank of mum and dad”. It is a leg up only available to those with wealthy and willing parents, accentuating the socio-economic divide between owners and renters.

What will have to change?

There are at least three important implications.

First, debt-free home ownership in old age can no longer be regarded as the norm; instead, mortgage stress in old age will become more common as churners take on more debt later in order to regain home ownership.

This raises complex questions around how ageing mortgage holders will manage retirement strategies, superannuation payouts and spending to cope with mortgages that aren’t extinguished.

Second, lifelong renting will become more common. This means governments will need to prepare for an upsurge in spending on housing assistance and pressure for legislation to provide greater security of tenure for private renters.

Read more:

Can the private rental sector provide a secure, affordable housing solution?

Evidence suggests mortgage indebtedness depresses wellbeing. On the other hand, people who have abandoned their mortgage experience a notable rebound in wellbeing, especially if they get secure rental tenure.

Finally, governments cannot just focus on programs that help first home buyers, such as the First Home Loan Deposit Scheme announced during the election. They will need to design programs that help prevent people from dropping out and help former owners get back.

The growing twilight zone between being an owner and being being a renter is largely unrecognised in the political imagination.

Read more:

More people are retiring with high mortgage debts. The implications are huge

High debt = mortgage debt-to-income ratio above 200%, middle debt = 100-200%, low debt = below 100%.

Author's calculations, ABS 6553.0 microdata

Less ownership, more churning

In each age group there is more renting and less ownership than there used to be.

And among owners, there is much less outright ownership and much more high debt than there used to be, exposing more of them to the risk of losing their homes.

Indeed, data from the Household, Income and Labour Dynamics survey shows that in the first decade of this century alone, nearly 2 million people left home ownership and returned to renting.

These “leavers” represent one fifth of all home owners in the decade.

But this wasn’t a one-way street either. Of those who lost their home, nearly two-thirds regained home ownership later in the decade. Astonishingly, 7% of these “churners” moved in and out of home ownership more than once.

Who’s leaving, who’s churning?

The edges of home ownership are becoming permeable, in an especially Australian way. Leavers and churners are more common in Australia than in Britain, a country which on the surface has a similar high home ownership rate and a well-developed mortgage market.

Leavers appear to be characterised by mortgage stress, divorce or relationship breakdown and poor health. They have better chances to regaining ownership if they were able to extract relatively large amounts of home equity before they leave.

Those who are able to find rent-free housing, say from parents, find it easier to save for a deposit to get them back into home ownership.

Some are able to directly access the “bank of mum and dad”. It is a leg up only available to those with wealthy and willing parents, accentuating the socio-economic divide between owners and renters.

What will have to change?

There are at least three important implications.

First, debt-free home ownership in old age can no longer be regarded as the norm; instead, mortgage stress in old age will become more common as churners take on more debt later in order to regain home ownership.

This raises complex questions around how ageing mortgage holders will manage retirement strategies, superannuation payouts and spending to cope with mortgages that aren’t extinguished.

Second, lifelong renting will become more common. This means governments will need to prepare for an upsurge in spending on housing assistance and pressure for legislation to provide greater security of tenure for private renters.

Read more:

Can the private rental sector provide a secure, affordable housing solution?

Evidence suggests mortgage indebtedness depresses wellbeing. On the other hand, people who have abandoned their mortgage experience a notable rebound in wellbeing, especially if they get secure rental tenure.

Finally, governments cannot just focus on programs that help first home buyers, such as the First Home Loan Deposit Scheme announced during the election. They will need to design programs that help prevent people from dropping out and help former owners get back.

The growing twilight zone between being an owner and being being a renter is largely unrecognised in the political imagination.

Read more:

More people are retiring with high mortgage debts. The implications are huge

Authors: Rachel Ong ViforJ, Professor of Economics, School of Economics, Finance and Property, Curtin University