Mothers have little to show for extra days of work under new tax changes

- Written by Miranda Stewart, Professor, Crawford School of Public Policy, Australian National University

The federal government’s new Child Care Subsidy (CCS) starts from July 2, 2018. The government has also announced personal income tax cuts. But these policies still don’t stop many women facing high effective marginal tax rates – as much as 95% for those in low-income households – on income from extra days worked. This is because the extra earnings interact with policies including income tax rates, the Medicare levy and losing family benefits, combined with the net cost of child care.

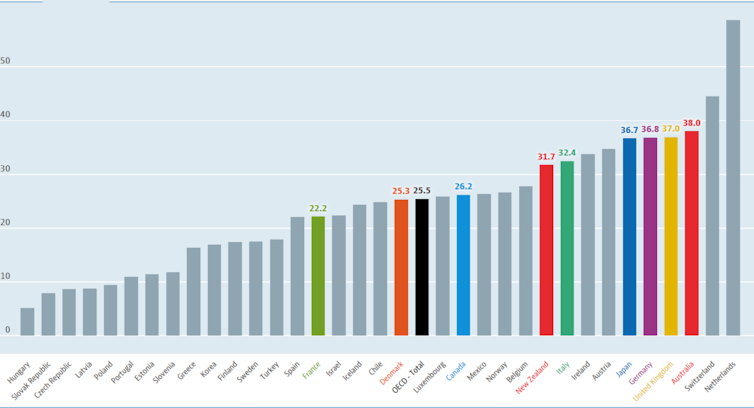

The evidence suggests that high effective marginal tax rates deter women, especially those with young children, from working more. Female workforce participation is increasing, but Australia has one of the highest rates of female part-time employment in the OECD (under 30 hours a week).

The ABS Gender Indicators show that 45% of women employed were part-time in 2016-17. For men, it’s only 16%. Of women caring for a child under the age of 5, 61% work part-time – for men it’s 8%.

Figure 1: Part-time employment rate for women as % of employment (2017 or latest data, Australia is in red).

OECD data

Figure 1: Part-time employment rate for women as % of employment (2017 or latest data, Australia is in red).

OECD data

The income tax cut does not help much

For the 2018-19 year (if enacted), a Low and Middle Income Tax Offset (LMITO) will reduce tax by up to $530 for individuals with taxable income up to $125,333, with the threshold for the 37% marginal tax rate rising from $87,000 to $90,000. Later stages remove the 37% rate altogether, replace the LMITO and increase the 45% rate threshold to $200,000. The Parliamentary Budget Office modelled that overall these tax cuts benefit men more than women.

Of course, the tax law does not have “pink forms and blue forms”, as Treasurer Scott Morrison remarked. The unequal gender effect of the tax cuts is because men have much higher incomes than women. And that is because of substantive inequalities between men and women in work participation, continuing wage discrimination, and because women assume most family care responsibilities.

The new Child Care Subsidy helps, a bit

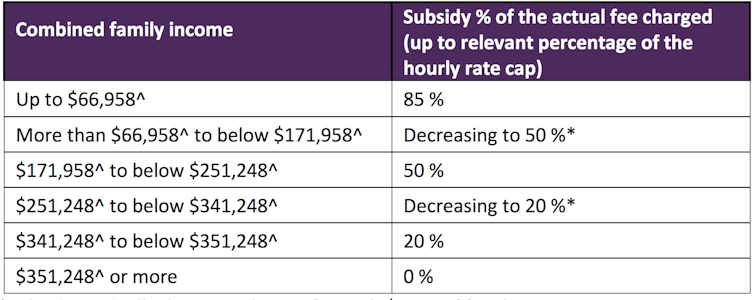

The CCS replaces the Child Care Benefit and Rebate from July 2. The expanded subsidy was estimated to cost $3.5 billion over 5 years in the 2015-16 budget. It increases the subsidy per child up to a cap of $11.77 per hour (or $117.70 for a full day of child care) and is phased out at higher incomes. But, importantly, the phase-out is still based on joint family income.

Table 1: Child Care Subsidy rates. *Subsidy decreases by 1% for each $3,000 of family income.

Department of Education & Training, Author provided

Table 1: Child Care Subsidy rates. *Subsidy decreases by 1% for each $3,000 of family income.

Department of Education & Training, Author provided

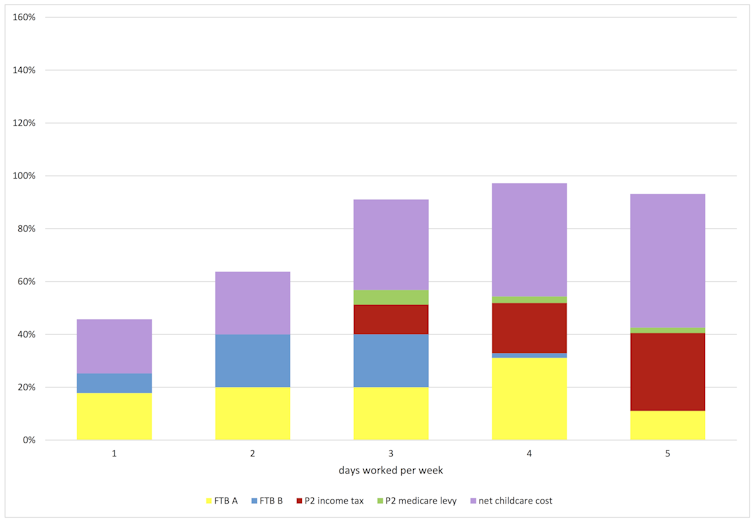

We modelled the combined effect of the CCS with the LMITO and other tax and family payment settings, for a moderate-earning and an average-earning family, with two children under 5. Our aim was to find the effective tax rate on the second earner (usually the mother) per day of work from one to five days a week.

Taking account of the Child Care Subsidy and Family Tax Benefits A and B decreasing as combined family income increases, coupled with the income tax and Medicare levy, mothers returning to work still face very high effective marginal tax rates on their earnings.

The families we model benefit from the proposed LMITO but not from the increased 37% tax threshold – they don’t earn enough for that. The daily effective marginal tax rate is measured on an increment of one day’s wage, including cost of child care that day (after the subsidy is applied). It is the effective average tax rate on each day’s increment.

Child care fees in the major cities range from about $85 a day to more than $137 a day. We model the government’s child care cap of $117.70 per day ($11.77 per hour).

Figure 2 shows that the second earner on a low wage faces a high effective marginal tax rate of between 85% and 95% on moving from two days a week to three, four or five days a week of work.

In dollars, this means the family is better off by about $4,000 in total over the year, as a result of the second earner increasing her work hours from two days a week to full-time, in spite of extra earnings of more than $27,000. That’s a substantial disincentive to increase her work hours.

Figure 2: Effective marginal tax rate on second earner in low-income family. Primary earner $52,730 (full-time), second earner $44,880 (equivalent to $8,976 per year per extra day a week worked); two children ages 2 and 3, child care $11.77 per hour per child.

D. Plunkett, Author provided

Figure 2: Effective marginal tax rate on second earner in low-income family. Primary earner $52,730 (full-time), second earner $44,880 (equivalent to $8,976 per year per extra day a week worked); two children ages 2 and 3, child care $11.77 per hour per child.

D. Plunkett, Author provided

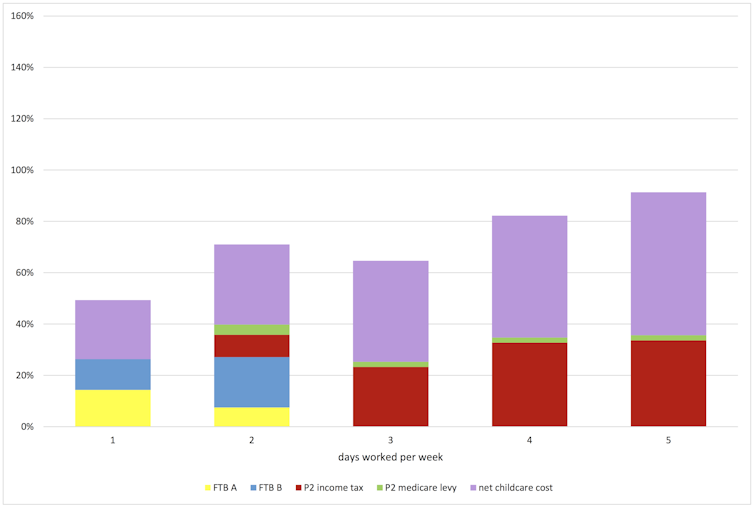

A family earning average wages is better off, but the second earner still faces effective marginal tax rates in excess of 80% on days 4 and 5 of work, as shown in Figure 3.

Figure 3: Effective marginal tax rate on second earner in average-earning family. Primary earner $87,000, second earner up to $70,000 (equivalent to $14,000 per year per extra day a week worked); two children ages 2 and 3, child care $11.77 per hour per child.

D. Plunkett, Author provided

Figure 3: Effective marginal tax rate on second earner in average-earning family. Primary earner $87,000, second earner up to $70,000 (equivalent to $14,000 per year per extra day a week worked); two children ages 2 and 3, child care $11.77 per hour per child.

D. Plunkett, Author provided

KPMG has modelled a higher earner with similar results.

A more efficient, fairer policy

These high effective tax rates are produced because the second earner’s salary is piled “on top” of the primary earner’s income. The Child Care Subsidy phases out based on combined income as the second earner moves from part-time to full-time earnings. Families avoid this effect if they can find cheaper child care, or can rely on grandparents to look after children.

As we face an ageing population, increasing women’s paid work hours would pay dividends for us all. Part-time workers are untapped potential for economic growth and productivity, household saving, women’s economic security and independence – and tax revenue. Spending public money on making child care more universal would be a much better, and fairer, investment than delivering tax cuts to high-income earners – mostly men.

Authors: Miranda Stewart, Professor, Crawford School of Public Policy, Australian National University