Gaw Capital Partners Ranks 3rd in PERE's 2023 Proptech 20 with Notable Increase in Capital Raised

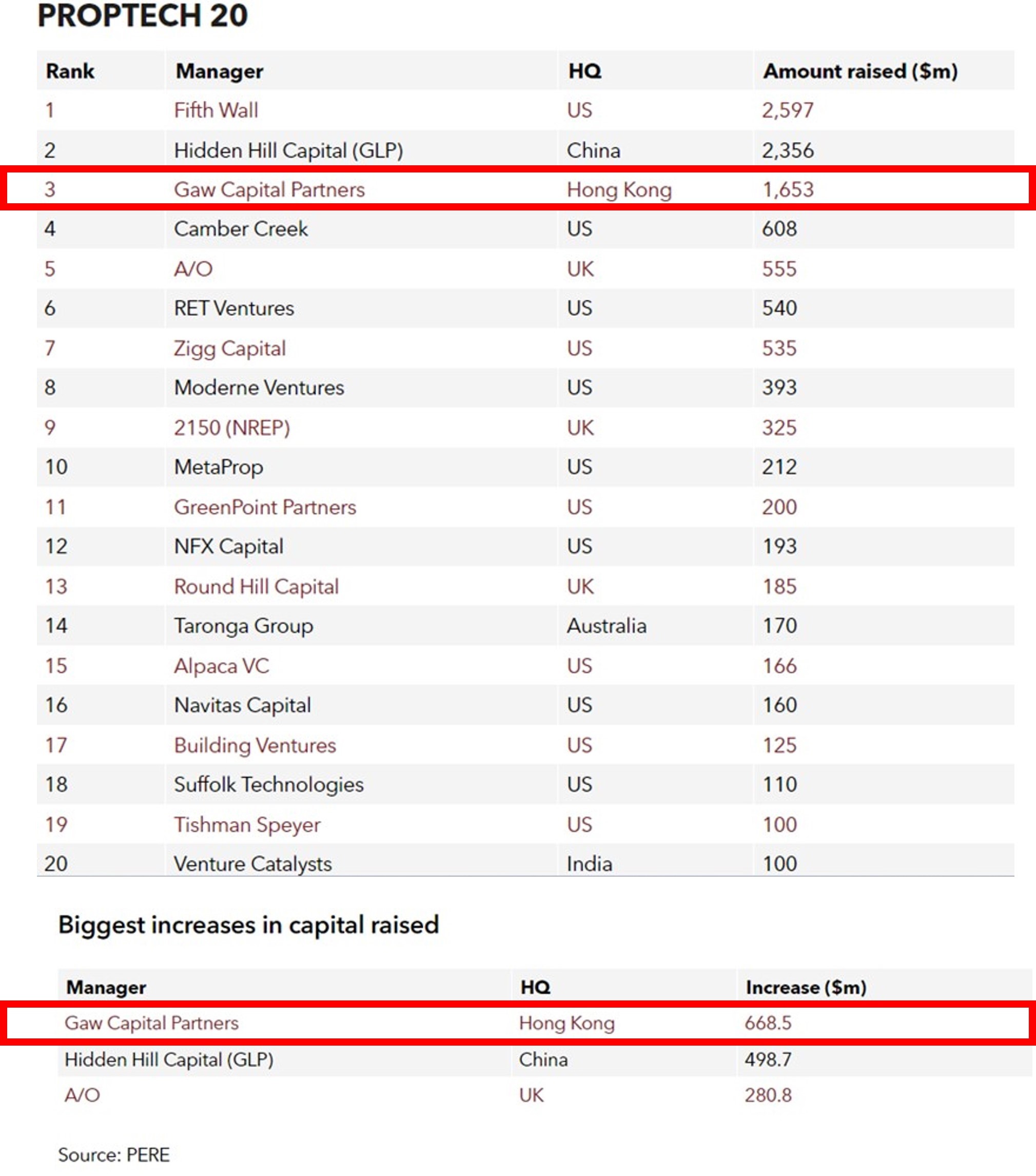

HONG KONG SAR - Media OutReach - 17 November 2023 - Gaw Capital Partners ranked third in the PERE's 2023 Proptech 20, with the biggest increase in capital raised among all fund managers globally.

In 2023, Gaw Capital has raised US$1,653m over the past five-year period, with a notable increase of US$668.5m compared with last year.

The Proptech 20 ranking, compiled by PERE, evaluates firms based on the amount of proptech direct investment capital raised between January 1, 2018, and June 30, 2023. According to PERE, despite the challenging macroeconomic landscape, PERE's Proptech 20 ranking has reached a significant milestone in 2023, surpassing an impressive US$10 billion in total fundraising, with US$11.28 billion amassed by the collective firms.

Gaw Capital's exceptional performance in the Proptech 20 ranking reflects the firm's unwavering commitment to innovation and its ability to navigate the ever-evolving real estate market. As one of the top fundraisers over the past five years, Gaw Capital continues to demonstrate its acumen in identifying and capitalizing on emerging trends in the proptech sector.

Christina Gaw, Managing Principal, Global Head of Capital Markets and Co-chair of Alternative Investments at Gaw Capital Partners, said, "We are thrilled to rank third in PERE's Proptech 20, which recognizes our team's outstanding capabilities in pursuit of our Sustainability (consisted of climate-tech, proptech and related sectors) venture portfolio. It is also a testament of our ability in adapting to the merging of opco and propco within the real estate industry, creating a more diverse investment opportunities landscape. We wish to extend our heartfelt gratitude to our valued investors for their continued trust and support."

Humbert Pang, Managing Principal, Head of China, and Co-chair of Alternative Investments at Gaw Capital Partners, said, "Achieving a prominent ranking in PERE's 2023 Proptech 20 is inspiring for us. The increasing popularity and development of innovative technologies in the Greater China region is further propelled by the continuous growth of smart infrastructure, and the Chinese government's supportive policies in tackling climate change to be a national strategy. At Gaw Capital, we stay at the forefront of combining proptech and climate-tech innovation and application, and by leveraging its transformative potential, we create long-term value for our investment shareholders and the society."

Gaw Capital Partners has raised a total amount of US$1,653 million for property technology over the past five-year period. Gaw Capital remains committed to staying at the forefront of proptech and climate-tech innovation and leveraging its transformative potential to create long-term value for our investors.

Hashtag: #GawCapitalPartners

The issuer is solely responsible for the content of this announcement.

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally.

Specializing in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and Education. The firm's investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the APAC region since 2005. The firm also manages value-add/opportunistic funds in the US, a Pan-Asia hospitality fund, a European hospitality fund, a Growth Equity Fund and it also provides services for credit investments and separate account direct investments globally.

Gaw Capital has raised equity of US$22.1 billion since 2005 and commanded assets of US$35.2 billion under management as of Q2 2023.