China’s 15th Five-Year Plan Signals Transformative Changes for Real Estate

Cushman & Wakefield Report Highlights Five Key Market Impacts

HONG KONG SAR - Media OutReach Newswire - 24 November 2025 - Global real estate services firm Cushman & Wakefield has released its The 15th Five-Year Plan — Reshaping China's Real Estate Market Landscape for the Next Five Years report.It provides an expert interpretation of the communique from the Fourth Plenary Session of the 20th CPC Central Committee, and explores how the new Five-Year Plan (FYP) will influence China's real estate market from 2026 to 2030.

The 15th FYP marks a notable juncture in China's pursuit of its "Two Centenary Goals." It serves as the operational blueprint connecting to the 14th Five-Year Plan and laying the foundation for modernization by 2035, and will also reshape the future landscape of China's commercial real estate market.

During the 14th FYP period, China faced unprecedented challenges: the COVID-19 pandemic, rising anti-globalization sentiment, and geopolitical volatility. These factors slowed global economic momentum and created complex pressures on China's growth trajectory. Consequently, the nation faces mounting pressures on both domestic and international fronts, necessitating timely and coordinated policy solutions.

In response to these challenges, the government has adopted a strategic framework focused on "domestic circulation as the core, reinforced by international circulation."

The 15th FYP serves as the operational blueprint for executing this strategy. It outlines a comprehensive set of priorities aimed at driving sustainable and inclusive growth over the next five years, including the building of a modern industrial system, technological self-reliance, domestic market cultivation, and high-level opening up.

Cushman & Wakefield identifies five major impacts on real estate:

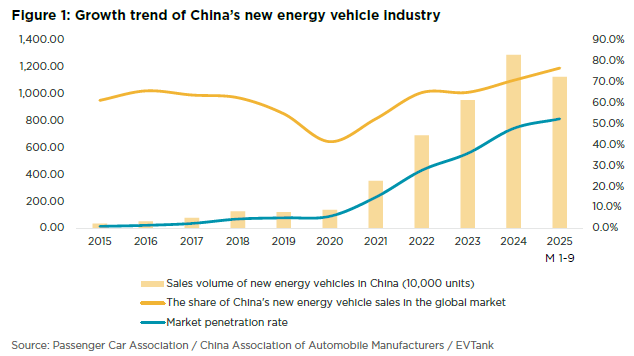

New Productive Forces Driving Office and Industrial Demand

The FYP prioritizes a modern industrial system to optimize traditional industries, expand emerging industries, and position for the future. Strategic sectors such as new energy vehicles and biomedicine have already achieved large-scale growth. New energy vehicle production reached 12.8 million units at the end of 2024, with a compound annual growth rate of 72% and a global market share of 76.4%. In the first five months of 2025, China's share of global large-scale pharmaceutical industry transactions surged to 42%. And in AI manufacturing technologies, China leads globally in industrial robot installations, with 276,300 units in 2023 — six times Japan's total. Over the next five years, policy and capital support for industrial and technology enterprises will likely spur demand for office space and industrial parks, enabling a recovery and new growth phase.

Growth trend of China's new energy vehicle industry

Domestic Demand Expansion Boosting Retail Development

The 15th FYP highlights a model of "new demand leading new supply, and new supply creating new demand," marking a shift from reliance on material investment and supply-side reforms to leveraging both supply and demand. Over the past few decades, China has achieved success in "investing in physical assets" such as infrastructure, real estate, and manufacturing equipment, but investment in human capital and public welfare has lagged behind.

The FYP signals a policy shift toward addressing public concerns such as education, social security and employment, healthcare, and housing. Policies such as childcare subsidies and free preschool education aim to unlock consumption potential. Consumer infrastructure REITs have become a market hotspot, with all 11 listed products posting strong gains. As at October 15, 2025, two REITS — Cathay Shih Mei and E Fund Huawei Farmers' Market — recorded gains exceeding 70%. As the government continues to stimulate consumption and consumer-focused REITs expand, retail assets should attract growing investor interest, prompting brand repositioning and exploration of new demographics and demand sources.

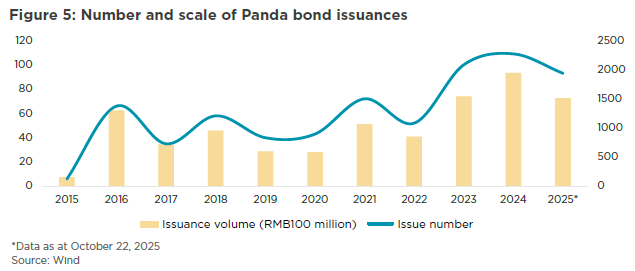

High-Quality Opening-Up Attracting Global Capital

Despite global protectionism, China's two-way opening-up has yielded significant results. As a core asset class for global capital allocation to the RMB, Panda bonds have surpassed RMB1 trillion in issuances, benefiting from financing cost advantages. The FYP's policy certainty and defined targets, together with expectations for RMB appreciation, are also expected to attract global capital back into China's capital markets. Over the medium to long term, China asset classes such as retail properties, industrial logistics facilities, data centers, and office buildings are likely to garner growing interest from international investors.

Number and scale of Panda bond issuances

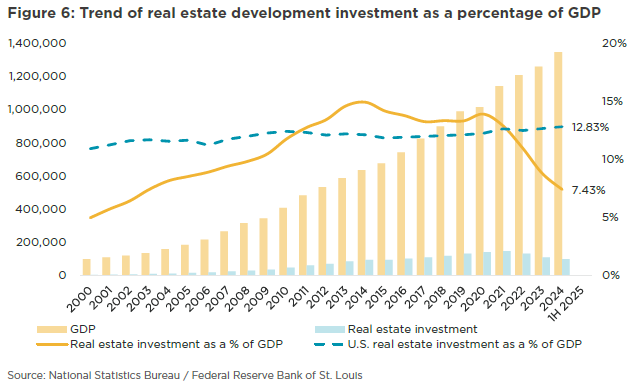

Livelihood Improvements Supporting Real Estate Growth

The FYP highlights real estate sector development within the context of improving people's livelihoods, reflecting a fundamental shift in the role of real estate in national economic development. Total real estate investment as a share of China's GDP dropped to 7.4% in 2024 from nearly 15% in 2014, while remaining under the United States' average of around 12%. Future market growth policies will focus on the construction of affordable housing, the development of the rental market, and urban renewal.

Trend of real estate development investment as a percentage of GDP

Accelerating Green Transformation

The FYP prioritizes sustainability in the real estate industry, with approximately 100 national-level zero-carbon industrial parks to be established by the end of the FYP period. A UN Environment Program report for 2024-2025 shows that the global construction industry accounts for 34% of carbon emissions, indicating a significant opportunity for emissions reduction in the real estate sector. ESG considerations are increasingly shaping the sector, with ESG principles becoming a key indicator for evaluating the value of commercial real estate projects.

Sabrina Wei, Chief Policy Analyst and Head of Research, North China, Cushman & Wakefield, said, "The 15th Five-Year Plan, as a blueprint for the 'accelerated period' of modernization, is driving China's economy to shift from investment and export dependence to a new model underpinned by domestic demand and coordinated supply and demand.

The positive impacts of key FYP themes will see the commercial real estate industry usher in an upgrade period across four subsectors: industrial real estate, retail properties, cross-border asset allocation, and green real estate. In the next five years, the combined effects of policy dividends, capital inflows, and consumption upgrades will open up greater development space for China's commercial real estate, helping the industry achieve high-quality transformation."

Please click here to access the full report.

Hashtag: #CushmanWakefield

The issuer is solely responsible for the content of this announcement.